MORE CONTEXT

LESS RISK

Stop nuclear claims

Save lives

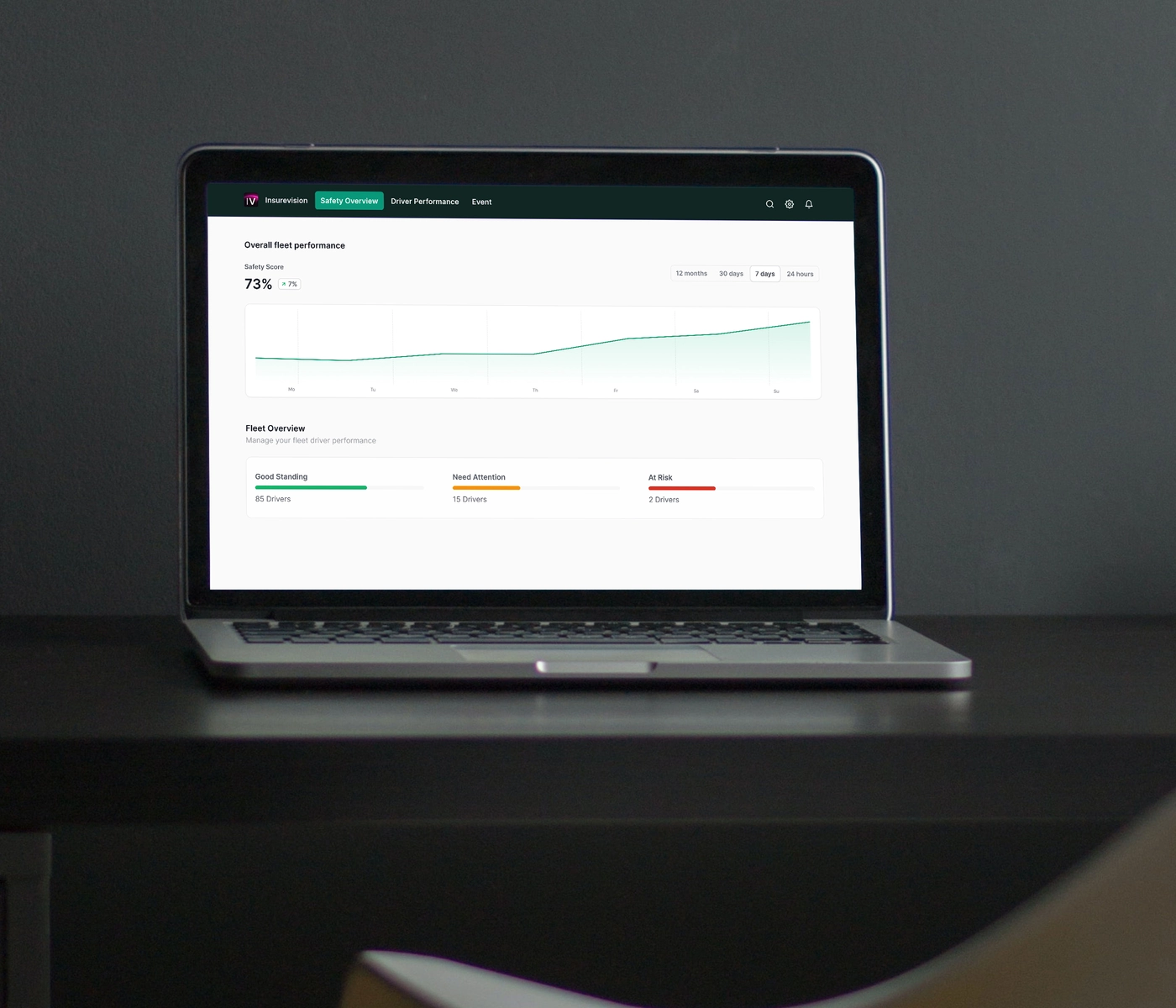

InsureVision uses state of the art end-to-end models to unlock the context in forward-facing dashcam video. We understand fleet risk and individual driver risk, providing you with actionable insights.

HOW WILL WE

INSURE YOUR

SAFETY?

Risk

Understanding

Just like a human, but faster, our solution sees and understands the whole environment and comes to a clear conclusion. A conclusion that helps deliver a more accurate measure of risk.

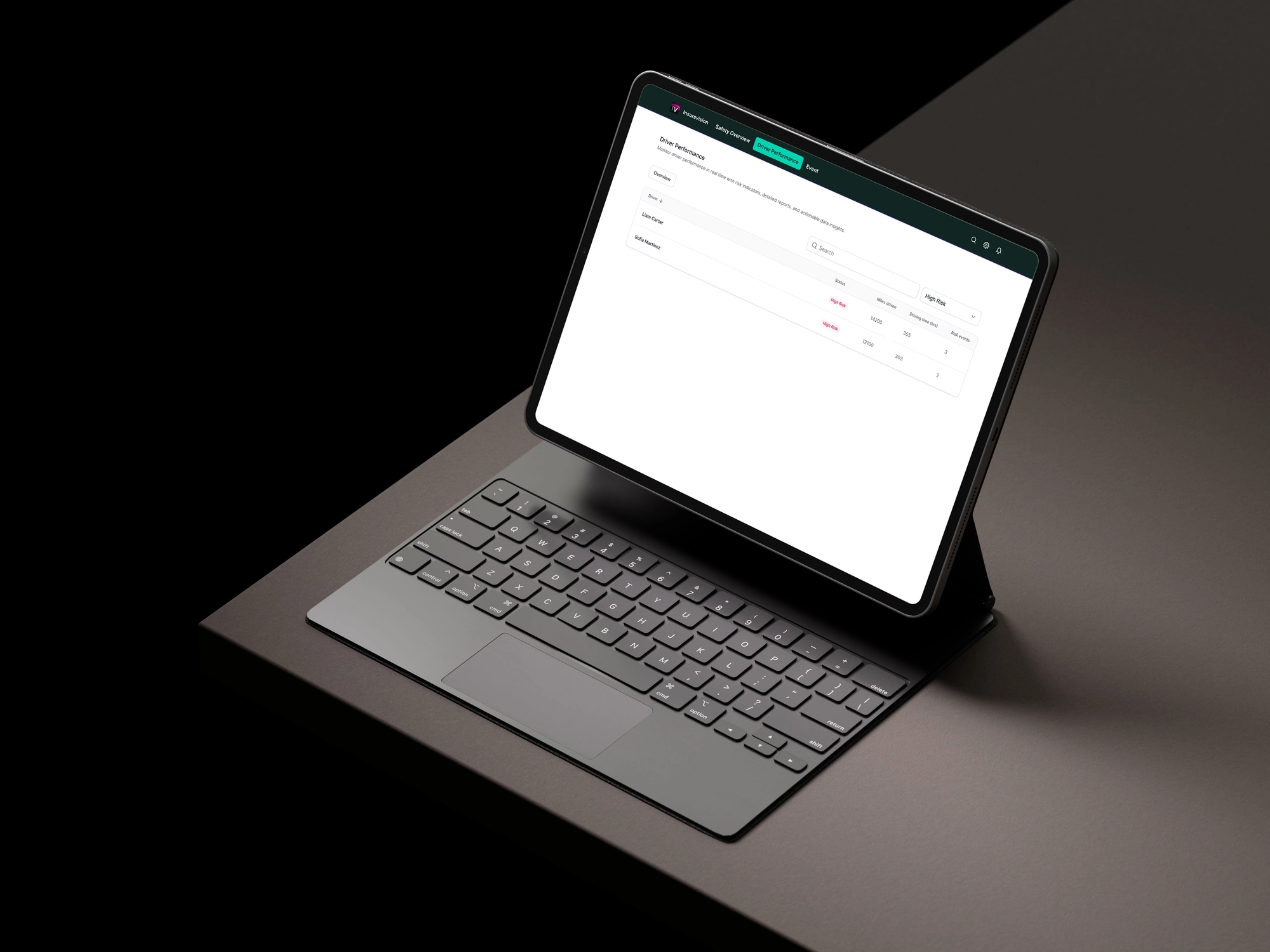

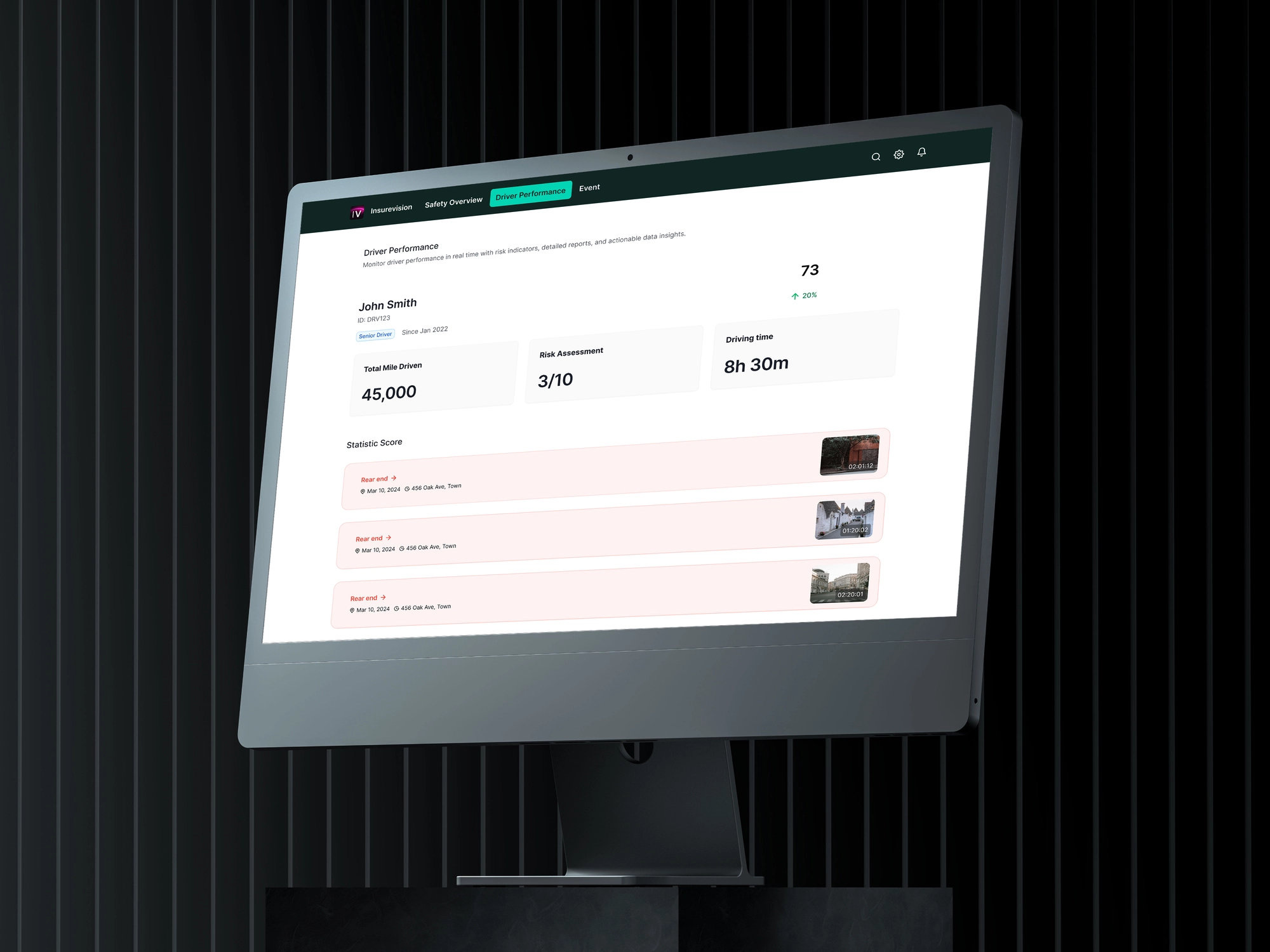

Pinpoint Driver

Analytics

Cut through the noise and endless event clips of harsh braking and distracted driving, and find those drivers who are at risk of high-value fault claims.

Measure Driver

Engagement

Our risk understanding is so fine-grained you will be able to track in realtime the impact of your driver coaching programs. Drivers exhibiting poor driver behavior and not responding to driver coaching represent a catastrophic risk to your business. We help you manage that.

Humans assess driving risk visually

Focusing on danger based on experience

Not on sensor data or object classification

Introducing

ENVIROMATICS

TELEMATICS 2.0

Technology built based on real

world scenarios

ACCESS &

EXTRACT

Extract forward video from any dashcam or Android-Automotive (AAOS) equipped vehicle.

ANALYZE &

PREDICT

Extracted video is analysed in the cloud or on the edge and turned into actionable insights, delivering realtime risk understanding.

COACH &

IMPROVE

InsureVision identifies the specific patterns of behavior that are likely to generate claims, focusing on learned vs heuristic estimates of risk, revolutionising the impact of driver coaching programs.

Mark founded InsureVision in 2022 with a vision to end road deaths globally. Prior to founding InsureVision, he founded the largest medical speech recognition company in Europe.

Dan led the development of a pioneering telematics insurance product at the UK’s Direct Line Group. Dan’s expertise in helping familiarise the insurance sector with cutting edge technology is an essential skill in building our offer.

Hossein studied his PhD at Johns Hopkins and is an expert in transformer AI. He's published multiple papers on the subject and built a state-of-the-art financial LLM at his last company.

MEET THE TEAM

Deploying across the eco-system

Join the future with us now.

Get in touch to learn more.